Retirement Tax Trap? What You Need to Know About Tax Deferral

[ad_1]

Would you like to pay less in taxes this year? is a trick question. A pertinent answer is another question: will it cause me to pay more in taxes later? If not, duly paying less in taxes is a no-brainer. But when paying less in taxes now is merely tax-deferral, the decision can be brain-racking. It involves comparing the tax reduction received now and the taxes expected to be paid later. We’d rather not pay more later than we save now. So, before kicking the tax can down the road, it’s wise to look ahead.

This matters a great deal because opportunities to defer taxes abound. For instance, retirement saving commonly involves tax-deferred accounts like 401(k)s, IRAs, and 403(b)s. Although they’re individual accounts, we might as well think of them as joint accounts because Uncle Sam expects his share when we take withdrawals. How much we get to keep depends on how good a long-term tax plan we craft.

Recommended Read: The Golden Year’s Guide to Tax-Free Retirement

Tax aversion may compel retirement savers to defer all the taxes they can, year after year. Sometimes, that’s the right thing to do. But not always.

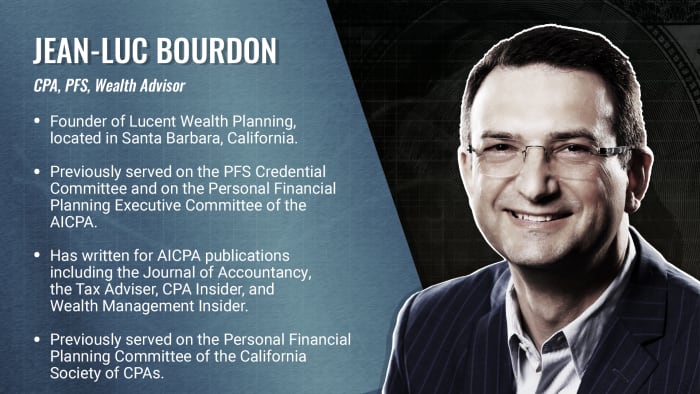

BIO| More About Our CPA and Tax Expert

Common Examples

The common assumption justifying retirement tax deferral is that we’ll be in lower tax brackets in retirement than during our working years. It’s a general assumption that’s not always true. While we’re saving for retirement, we might be in a low tax bracket due to the mortgage interest deduction, the benefit of having dependents, and filing married-jointly, for example. By contrast, we might be in higher tax brackets in retirement because of wealth accumulation or using the single filing status.

When retirees have too little money outside tax-deferred accounts, exceptionally large expenses can require taxable withdrawals that cross into painfully high tax brackets. Then, taxes might dissuade retirees from taking discretionary withdrawals they would otherwise enjoy (e.g. remodeling, bucket-list travel). For unavoidable expenses, such withdrawals can add tax salt to the financial wound.

To make matters worse, the cost of receiving Medicare parts B and D can increase when income goes up, thus potentially amplifying the cost of taking money out of tax-deferred accounts.

Postponing distributions from tax-deferred retirement accounts can also build a tax trap. Generally, distributions may be taken penalty-free starting at age 59 ½ and must be taken yearly starting at age 72. These are the notorious Required Minimum Distributions or RMDs. One of the tax code’s many exceptions allows employees to postpone RMDs past age 72 if they keep working, among other requirements. Therefore, I once met an employee in his eighties who had deferred distributions so long that he couldn’t bring himself to retire and pay very high taxes on his 401(k) account’s RMDs. To tax defer can retirement deter!

It’s a rare situation and the moral of the story is not to avoid tax deferral. Not at all. The lesson is to start early on a long-term tax plan.

Scroll to Continue

How to Avoid Building a Retirement Tax Trap

Make long-term tax planning a focus of your financial plan. For example, estimate the size and sources of your retirement income. Plan its timing and consider retirement income tax strategies, such as opportunistic Roth conversions.

Consider your saving options. For example, if your job offers a potentially tax-free Roth 401(k), is it a good option for you? Should you contribute to a traditional IRA or a Roth IRA? Would a taxable account be beneficial as part of your savings mix? Do you qualify for an HSA? The answer to these questions may change from year to year, so regularly revisit them.

As best as you can forecast, evaluate if deferring taxes make sense in your unique tax and overall financial situation. For instance, I once met a low-income heiress contributing to a 401(k). Once she receives her inheritance, she’ll presumably be in a much higher tax bracket for life. Then, taxes on distributions from the 401(k) will cost more than the benefit she initially received for contributions.

Mitigate uncertainty with flexibility. Options are nice because life is full of surprises, welcome or not. As such, it’s useful to have various resources to manage taxes along retirement’s twists and turns. For example, to pay for unusually large expenses, it could be helpful to tap tax-free funds, like a Roth IRA. By contrast, to fully utilize unusually high tax credits and deductions (e.g. EV credit, medical expenses), some retirees may need to increase taxable distributions.

TheStreet Recommends: Who Benefits Most From the Tax Code?

The tax code is full of giving and take. Of course, it mostly takes. When we do get a tax break, it’s important to know if we’re expected to pay it back. Modern retirement, with its array of tax-advantaged accounts, confronts us with many decisions: how much to save, which account(s) to fund, and what investments to choose. But that’s not all. Retirement will require us to take money out. That’s the whole point, isn’t it? We should then also plan to avoid finding ourselves in a tax trap, have a long-term tax distribution plan, and make the most of what we get to spend.

More Tax Advice From Our Partners at TurboTax.com:

Editor’s Note: This article is for general information and educational purposes only and is not intended to serve as specific financial, accounting, legal, or tax advice. Individuals should speak with qualified professionals based on their circumstances. The analysis contained in this article may be based upon third-party information and may become outdated or otherwise superseded without notice.

The content was reviewed for tax accuracy by a TurboTax CPA expert.

[ad_2]

Read More:Retirement Tax Trap? What You Need to Know About Tax Deferral