Commercial real estate sees healthy demand in Q2, says Nareit (BATS:REM)

[ad_1]

kazuma seki

Commercial real estate saw healthy demand across most sectors in Q2 despite a slowing economy, which reflected in their continued solid fundamentals, according to a report by National Association of Real Estate Investment Trusts.

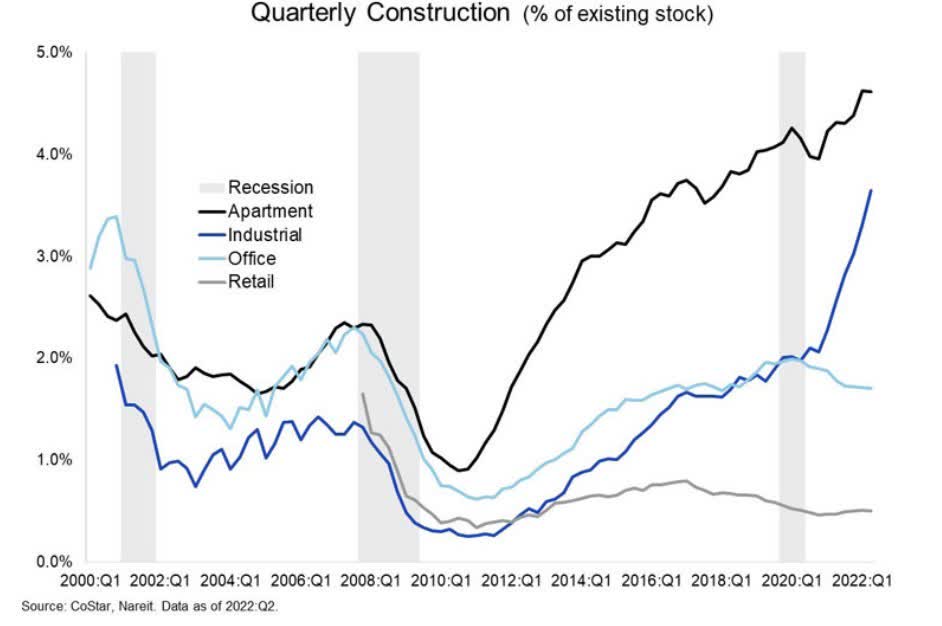

Apartment construction as a percent of existing stock remained near its peak level at 4.6% during the quarter. Meanwhile, for industrial construction, the figure stood at an all-time high at 3.6% of existing stock, with nearly 650M sq.ft. of new facilities under construction.

However, office construction waned with the uncertainties over how work from home may impact the sector, reaching 1.7% of existing stock during the quarter.

Retail construction maintained a level around 0.5% of existing stock since the middle of 2019, with 59.4M sq. ft. of retail properties under construction in Q2.

Here is a look at the quarterly construction across different sectors:

Net absorption continued to be higher than net deliveries for both industrial and retail, while it was the vice versa for apartment and office.

Office and apartment vacancy rates were higher, driven by market fundamentals. However, industrial and retail vacancy rates were lower.

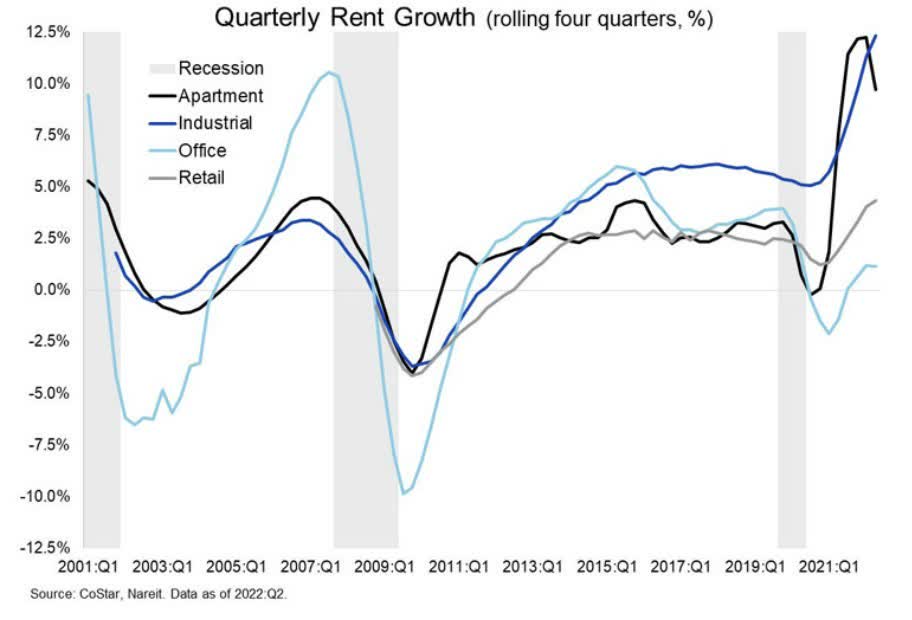

The rolling four-quarter rental growth rates remained positive across all sectors, Nareit said in the report.

For Q2, apartment rental growth rate moderated to 9.7%, while the industrial sector saw rents increase by 3.1%.

Office rents saw modest growth of 1.2% in the quarter, far below the pre-pandemic levels. Retail rent growth also stood at 1.2%.

Here is a look at the quarterly rental growth across the different sectors:

[ad_2]

Read Nore:Commercial real estate sees healthy demand in Q2, says Nareit (BATS:REM)

Canada

Canada Japan

Japan Germany

Germany Australia

Australia United States

United States United Kingdom

United Kingdom China

China France

France Ukraine

Ukraine Russia

Russia Turkey

Turkey