Anywhere Real Estate Q2 2022: Successful Turnaround Unlikely

[ad_1]

ArLawKa AungTun/iStock via Getty Images

Turnaround stocks are always tempting because they usually look cheap and the upside is big if the turnaround is successful. But inherent to the fact that it’s a turnaround is the fact that there was a long-term business decline or stagnation up to the point of analysis. This means that generally growth, tailwinds, and a proven track record are not on your side if you’re an investor in the company. There’s also usually a high net leverage ratio.

Anywhere Real Estate Inc. (NYSE:HOUS) falls into this category. The stock is down 80% from its peak in 2013. Revenue is up about 50% since then but earnings are flat, so most of the decline can be attributed to multiple compression.

Anywhere Real Estate EV/EBIT (2012-2022) (Seeking Alpha)

In 2013 the stock reached a peak EV/EBIT multiple of about 40 with $525 million in EBIT and a stock price of $50. Today the EV/EBIT multiple is about 9, 2021 EBIT was $600 million and the stock trades at $10. This paints of picture of the market slowly losing faith in the company over the course of a decade as margins dropped due to increased competitiveness in the industry, all while growth failed to make up for it.

That brings us to where we are now. What does the future hold for Anywhere Real Estate? Along with the rebrand from Realogy, management has laid out a path to sustained growth and increased profitability, the main points being more cost cutting measures to improve profitability and “high impact technology” that improves agent efficiency. This is a nice plan in theory but I wouldn’t bet on this turnaround to be successful over the long run. I think this is a business in decline and that the stock will continue to reflect this decline.

If I’m right, that will all be apparent over the next 5-10 years. But could there be short term upside? The market seems to be pricing in a housing crash scenario for some stocks (thinking mainly about home builders and housing supply companies) and this could be leaking over the brokerage industry. The current slowdown will likely continue but I don’t think the “housing bubble burst 2.0” scenario will play out. Even so, the market is fearful of a housing market crash and Anywhere Real Estate’s stock could be difficult to hold especially if investors don’t believe in the long term turnaround plan.

The Turnaround Plan

Management has been emphasizing cost reductions as the main way they will increase profitability. In the Q2 2022 press release they highlight up to $140 million in potential cost savings for the year. Cost savings are good but the counterweight to this is that the brokerage industry is getting much more competitive. As that trend continues, the real estate transaction commission split will become even more favorable for the agent. There isn’t much loyalty when it comes to choosing a brokerage; agents will go where they can make the most money. The commission split isn’t the only factor in that equation but it is a big one.

Along with the cost savings, Anywhere highlights its “high impact technology” that makes agents more efficient. I’m not an agent so I’m not expert on the different real estate platforms and the tech that goes into them. But this is the type of statement that I can’t trust at face value. In fact, given how software is constantly evolving and improving I think this statement necessarily can’t be true for a long period of time as the business is cutting costs rather than aggressively investing in its platform. This would be less of a concern if this was a low churn type of business but as I mentioned, agents will always go to the brokerage where they can make the most money. If Anywhere’s tech begins to lag behind as others brokerages invest heavily into their technology over the next few years, agents will leave.

Financials

Like most turnaround stocks, Anywhere Real Estate looks cheap. It’s currently trading at an EV/EBIT multiple of 9 and compared to other publicly traded brokerages that have much higher earnings multiples or are unprofitable, this looks like a steal. But it’s worth digging a little deeper.

First, the business over-earned in 2021. The multiple will increase over the course of the next two quarters because earnings will decline in the second half of the year just as earnings declined in the first half. The EV/EBIT multiple could be closer to 12-15 which is just about stock’s average from 2015-2020.

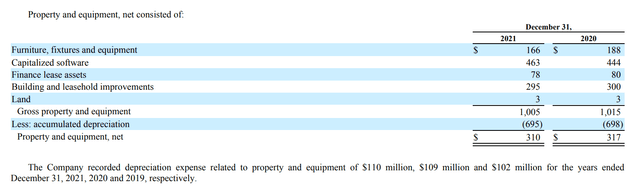

Second, it’s interesting to check how these earnings translate to cash flow. In the first half of 2022, there were working capital changes that affected cash from operations. This is not too concerning as I expect these to normalize in short time. What stands out is that capital expenditures are relatively high. With a closer look we can see that this is because property and equipment is comprised mainly of capitalized software. This makes GAAP earnings look better even though free cash flow and total earnings over time would be unchanged. If the software costs were instead expensed in the income statement the current EV/EBIT ratio would not look quite as good. This would not affect the economics of the business but it’s something to keep in mind.

Anywhere Real Estate 2021 PPE (Anywhere Real Estate 2021 10-K)

Finally, this isn’t the right macro environment to own highly leveraged turnaround stocks especially if the business operates in the real estate industry. I did say that I don’t think there will be a big housing market crash but the equity market is being very skittish with housing market data. Just take a look at the valuations of the big homebuilding companies. D.R. Horton, Inc. (DHI) is trading at an EV/EBIT of around 4, below the lows of the 2020 covid crash. Businesses in cyclical industries see a range of earnings multiples depending on which part of the cycle it’s in, but with this type of valuation the market is pricing these businesses for a huge earnings crash.

DHI is up about 25% from its recent lows and most housing related stocks are up with it but any more troubling housing data could send these stocks down. Highly leveraged companies like Anywhere Real Estate could be bid down even more due to existential business fears.

Final Thoughts

Despite management’s best efforts, I don’t see Anywhere Real Estate breaking out of its decade long trend of stagnation. The real estate brokerage industry is moving incredibly fast and becoming very competitive so it will take innovation and cutthroat pricing to succeed going forward. Anywhere Real Estate owns brands with a large market share but this isn’t a high loyalty business; at the end of the day agents will go where they can make the most money. With its cost cutting mindset, I don’t think Anywhere Real Estate will keep up technologically or culturally in the race to make agents better.

I also wouldn’t feel comfortable betting on the stock in the short term. It looks cheap on an earnings basis but it over-earned in 2021 and the trailing earnings multiple will drop over the next few quarters. It’s also highly leveraged with a 6x net debt to EBITDA ratio based on H1 2022 EBITDA annualized. This will make it more sensitive to a continued housing downturn or fears of a more aggressive housing downturn. This could create an opportunity for investors that believe in the long-term story but it could make the stock difficult to hold in the short term.

[ad_2]

Read Nore:Anywhere Real Estate Q2 2022: Successful Turnaround Unlikely